Getting The Pkf Advisory Services To Work

Getting The Pkf Advisory Services To Work

Blog Article

Some Ideas on Pkf Advisory Services You Should Know

Table of ContentsPkf Advisory Services Fundamentals Explained9 Simple Techniques For Pkf Advisory ServicesThe 8-Minute Rule for Pkf Advisory ServicesPkf Advisory Services for DummiesHow Pkf Advisory Services can Save You Time, Stress, and Money.

Most individuals these days know that they can not count on the state for even more than the outright essentials. Preparation for retired life is a complex company, and there are various choices offered. A monetary advisor will certainly not only help sort with the numerous policies and product choices and help build a profile to increase your long-term leads.

Buying a house is one of the most expensive decisions we make and the vast majority people require a home loan. An economic consultant might save you thousands, especially at times similar to this. Not just can they seek the most effective prices, they can assist you evaluate sensible degrees of loaning, take advantage of your deposit, and might also locate lending institutions that would certainly otherwise not be available to you.

The Ultimate Guide To Pkf Advisory Services

A financial advisor knows just how items operate in different markets and will certainly identify feasible downsides for you as well as the possible advantages, to ensure that you can after that make an informed choice about where to invest. As soon as your threat and investment analyses are total, the following step is to check out tax; even one of the most basic review of your placement could assist.

For extra complicated setups, it might mean moving properties to your partner or children to maximise their individual allocations rather - PKF Advisory Services. A monetary advisor will certainly always have your tax position in mind when making recommendations and point you in the ideal instructions even in complex scenarios. Also when your investments have actually been placed in area and are running to plan, they ought to be kept track of in instance market developments or unusual events push them off program

They can examine their efficiency against their peers, guarantee that your possession allocation does not become distorted as markets change and aid you consolidate gains as the deadlines for your ultimate goals move better. Cash is a complicated subject and there is lots to take into consideration to protect it and make the many of it.

An Unbiased View of Pkf Advisory Services

Using an excellent economic advisor can cut with the hype to guide you in the best direction. Whether you need basic, sensible suggestions or a professional with specialized proficiency, you could find that in the lengthy term the cash you purchase skilled advice will be repaid lot of times over.

Keeping these licenses and qualifications calls for constant education, which can be pricey and lengthy. Financial experts require to stay upgraded with the most up to date sector patterns, regulations, and ideal methods to offer their clients efficiently. Despite these difficulties, being a certified and qualified financial expert provides enormous benefits, More hints consisting of numerous job opportunities and greater earning capacity.

Some Ideas on Pkf Advisory Services You Should Know

Financial consultants work carefully with clients from diverse backgrounds, helping them navigate complex financial choices. The ability to pay attention, recognize their unique needs, and provide tailored advice makes all the distinction.

I started my occupation in business financing, moving and upward throughout the business money framework to develop skills that prepared me for the role I remain in today. My selection to relocate from business financing to individual financing was driven by individual demands along with the need to aid the several individuals, households, and small companies I currently offer! Accomplishing a healthy and balanced work-life equilibrium can be challenging in the early years of an economic advisor's career.

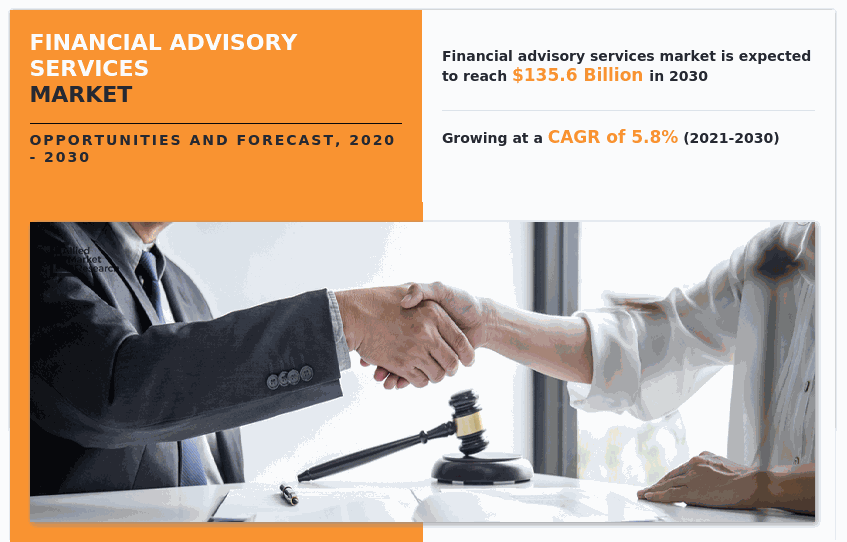

The economic consultatory profession has a weblink favorable outlook. This development is driven by aspects such as an aging populace calling for retired life planning and enhanced understanding of the importance of financial planning.

Financial experts have the unique ability to make a substantial effect on their clients' lives, assisting them achieve their financial goals and protect their futures. If you're passionate about money and helping others, this job path may be the ideal fit for you - PKF Advisory Services. To learn more information concerning ending up being a monetary expert, download our thorough FAQ sheet

The Definitive Guide for Pkf Advisory Services

If you would such as financial investment recommendations concerning your details truths and circumstances, please call a certified monetary expert. Any kind of investment entails some level of danger, and various kinds of financial investments involve varying degrees of threat, consisting of loss of principal.

Previous efficiency of any type of security, indices, technique or appropriation might not be a sign of future outcomes. The historic and existing details regarding guidelines, laws, standards or advantages contained in this record is a recap of details gotten from or prepared by various other sources. It has actually not been individually verified, yet was gotten from resources believed to be trustworthy.

A monetary consultant's most useful asset is not proficiency, experience, or perhaps the capability to produce returns for customers. It's count on, the foundation of any successful advisor-client relationship. It establishes a consultant besides the competition and keeps customers coming back. Financial professionals across the country we talked to agreed that use this link depend on is the essential to building enduring, productive connections with customers.

Report this page